Canada - British Columbia

Country Member Summary

Adapted from the report by the British Columbia Blueberry Council (BCBC)

Season Data:

Season Overview:

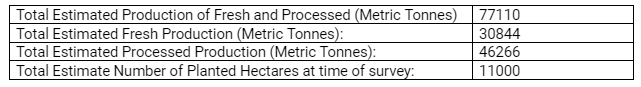

British Columbia (B.C.) produced an average-sized blueberry crop in 2021, estimated at 170 million pounds (77110 MT) despite increased acreage and maturation of existing plantings. Continuing the trend observed in 2020, labour shortages resulted in even more blueberries being harvested by machine and a greater proportion of the crop destined for processing. The weather during 2021 can best be described as ranging from challenging to extreme and unprecedented, these conditions resulting in lower-than-average yields on many farms. There was little winter damage entering the season, but cool spring temperatures and frequent rain showers combined with shortage of bee colonies and low bee activity during the early bloom period to result in sub-optimal pollination, though conditions and bee activity did improve during the latter half of bloom. Just as early cultivars were beginning to ripen, the Pacific Northwest was hit with a “heat dome” from June 25-29, causing damage to the blueberry crop in some regions, especially in the eastern Fraser Valley. ‘Duke’ and ‘Reka’, with substantial blue fruit at the time, suffered losses of fruit due to sunscald and reduced size of remaining fruit in some cases. Though the mid- and late-season cultivars had not yet begun to turn blue at the time, ‘Calypso’ and ‘Aurora’ suffered damage to green fruit. Commercial harvesting began in the first week of July and peaked a couple of weeks later due to a relatively concentrated season, resulting in a lot of overlap between ‘Duke’, a.‘Bluecrop’, and ‘Reka’ toward the end of July. Fruit quality was excellent with little fruit rot due to hot, dry weather conditions. The harvest of ‘Draper’ started in the end of July with ‘Calypso’ and ‘Liberty’; the harvest of ‘Elliott’ stretched from mid-August to mid-September; and the harvest of ‘Aurora’ and ‘Last Call’, the latter in diminishing amounts as plantings are removed, continued from late August to late September. Following the season, flooding impacted approximately 2,500 acres of blueberries in late November. Some fields were only flooded for a few days but up to 1,000 acres were flooded for more than two weeks and for as long as three weeks under up to 10 feet of water. Much of this acreage is either being replanted or stumped (i.e., renovation pruned) to stimulate plant recovery. While the full damage caused by this flooding has yet to be determined, BC does not expect this to substantially impact yields in the 2022 season as the severely flooded areas represent less than 5% of the acreage.

Varieties and New Plantings:

‘Duke’, ‘Bluecrop’ and ‘Elliott’ remain the three most widely grown cultivars in BC. ‘Duke’ comprises more than half of the current acreage.

New and existing acreage continues to be planted in BC, but at a slower rate than a few years ago. ‘Elliott’ fields are starting to be removed in favour of other cultivars, a trend that has increased with the greater prevalence of Blueberry Scorch Virus (BlScV) in the region. New plantings of ‘Duke’ are still very common, and an increasing amount of acreage has been planted to ‘Calypso’ in the past few years. ‘Calypso’ is likely to become the third most widely planted cultivar in the next few years, though total production volume of this cultivar will take some time to reach that of ‘Elliott’ and ‘Draper’ as these new plantings are not yet mature. ‘Top Shelf’ and ‘Valor’ continue to be planted in smaller blocks, and growers continue to look for new cultivar opportunities.

Production Challenges and Opportunities:

As in the previous year, variable weather patterns are impacting plant development and making it difficult to predict the timing of harvest each year. The overlap of ‘Duke’, ‘Reka’, and ‘Bluecrop’ harvests in 2021 continued to create challenges for growers and taxed the packing and processing capacity of the industry during the peak of the season.

The rising cost and limited availability of labour is a primary concern for producers. Costs of production are high in BC due to high labour costs, high land values, and high prices for agricultural inputs, particularly for pollination services and pesticides. The high costs of production have pushed growers towards more efficient methods of production. Over half of BC’s blueberry crop is harvested by machine for process markets.

Spotted wing drosophila (SWD) and weevils are the most difficult insect pests to manage in this region. SWD pressure in 2021 was low through July and the first half of August due to the hot weather mentioned above, but populations began to increase in late August. The high amount of precipitation in the spring and fall makes it difficult control fungal diseases such as Phomopsis and Godronia cankers, mummyberry and Botrytis and Anthracnose fruit rots.

Pollination is a challenge for BC growers. Pollination is often impacted when alternately rainy or overly warm weather conditions coincide with bloom.

To deal with these production challenges, BC growers are investing in applied field research in the areas of pest, disease and horticultural management as well as bee health and the development of new varieties. In particular, the British Columbia Blueberry Council (BCBC) breeding program is entering its fourteenth year of active development of new varieties. The program aims at increasing yield and fruit quality for machine harvest (e.g., increased fruit firmness and resistance to bruising and splitting), pest and disease resistance and local adaptation. Advanced selections are currently entering grower trials, the final step prior to their future commercialization through the British Columbia Berry Cultivar Development Inc. (BCBCDI).

Market Trends and Projections:

BC has approximately 600 growers and around 30 large-scale packers and processors. The industry will likely see consolidation in the coming years, as small-scale producers with less than 10 acres are finding it difficult to compete.

The abundance of blueberry fruit that hits the market across the Pacific Northwest during BC’s ‘Duke’ season results in low pricing for ‘Duke’ growers and puts significant strain on both fresh packing and processing capacity. BC growers are looking toward mid-season and mid-late-season varieties, especially for the marketing of fresh product.

BC typically sells around 70 million pounds into the fresh market. Depending on the size of the crop, between 50-65% of BC’s production goes to the process market.

BC recently rebranded its product to the world as Blueberries: Powered by Nature. The US is the largest market for BC’s export product, but other important markets include Japan, New Zealand, and South Korea.